Frequently Asked Questions

Below you will find information on the most frequently asked questions to help you whether you are managing your money from the comfort of your own home or if you are looking to learn more about Mid Minnesota. Please call us if you need more information, our staff is ready to help!

Account/Personal Information

How do I become a member owner of MMFCU?

If you live, work, worship or attend school in the geographic areas listed below, or are an immediate family member of someone who lives, works, worships, or attends school in these areas, you are eligible for membership. Immediate family includes spouse, parent, step-parent, child, step-child, grandparents, grandchild, brother, step-brother, sister or step-sister.

Mid Minnesota Federal Credit Union serves all of Becker, Cass, Crow Wing, Douglas, Morrison, Norman, Otter Tail, Todd, and Wadena Counties as well as the cities of Aitkin, McGregor, and Palisade, in addition to various townships in Aitkin County. Aitkin County Townships eligible for membership are: Aitkin, Farm Island, Fleming, Glen, Hazelton, Jeven, Kimberly, Lakeside, Logan, Malmo, McGregor, Morrison, Nordland, Shamrock, Spencer, Turner, Wealthwood, and Workman Townships.

You can become a member if you meet any of the above guidelines. A simple $5 deposit will make you a member owner of MMFCU – allowing you to apply for any of our free and low-cost services.

What is my routing number?

MMFCU’s routing number is 291973360. Looking to set up direct deposit? You’ll need your account number that you want the funds to go to. The same can be said if you are looking to set up automatic payments to another financial institution or company. See the below FAQ for how to find your account number.

What is my account number?

Each account that you have with us has its own unique account number. Again, our staff can help you get this information, but only after you verify a few pieces of information about yourself. You can also find your account numbers in online banking or the mobile app.

Setting up direct deposit? You will also need your routing number for the financial institution you want the funds to go to. The same can be said if you are going to set up automatic payments to another financial institution or company. See the above FAQ for what your routing number is.

What is my member number?

Your member number is essentially another form of ID for our staff to be able to pull up your account information. Your member number will be given to you at the time of opening your account. However, your member number is not used in any other way than to find you in our system. It is not necessary to know your member number, as there are multiple ways to find your accounts in our system, but if you should request it, staff can let you know after verifying a few pieces of information about you.

How do I update my address?

In Office or Drive-up

Visit your local branch, let them know that your address has changed, and they will verify some pieces of information before updating your address.

Over the phone

Call us at (218) 829-0371 to request your address be changed. Staff will verify a few pieces of personal information before updating your address.

In Online Banking

Log into your online banking account and click on settings. In the upper right corner at the top click the contact tab across the top. To update your address, click the little pencil to the right it will open up an option for you to enter your new updated address. Click Save. You will have to enter a verification code that will be sent either by text or email to verify your identity. Once you have completed this, your address will update in our system automatically. If you have a PO Box for a mailing address, you will need to change your address in an office, through the drive-up or request a change of address form over the phone.

How do I order more checks?

In Office or Drive-up

Staff at your local branch will be able to order checks for you. They will need to know which account you need them for and any updates on what you want included on the checks.

Account Related

How do I open an account online?

To open an account online, complete an online application. If you are new to MMFCU, we welcome you! As a part of the application process you will be asked to verify that you meet the criteria for being a member owner: live, work, worship, or attend school in any of the 10 counties in central MN that we serve, or are an immediate family member of someone who does. Immediate family includes spouse, parent, step-parent, child, step-child, grandparents, grandchild, brother, step-brother, sister or step-sister. For more information on the counties we serve see our About Us webpage.

If you need help with opening your account, please contact us at (218) 829-0371.

How do I transfer money to/from my account at another financial institution?

Make a Loan Payment Tool

To make a payment on a loan with MMFCU using funds from another financial institution, you can utilize our Make a Loan Payment Tool with a debit card or routing and account number from another financial institution.

Direct Pay

To send funds automatically from another financial institution to MMFCU, you can set up a direct pay. This works for loan payments as well. You are also able to set up a direct pay in your local office.

How do I know what is pending on my account?

To know what is pending on your account you can either call us at (218) 829-0371 or log into online or mobile banking. To see pending purchases or debits on your account, click on one of your accounts in online or mobile banking. Pending transactions will be listed at the top and marked as pending.

For pending deposits, you can contact us and our staff will be glad to help you.

How do I make a loan payment?

In Office or Drive-Up

Make your payment with the tellers.

Over the Phone

Call us at (218) 829-0371 and make the payment over the phone.

Write out a check for the payment amount and mail to us:

MMFCU

PO Box 746

Brainerd, MN 56401

Make sure that your name is on the check along with either the account number in the memo line or the type of collateral the loan is for (i.e: 2007 Dodge Ram, Mortgage Payment, HELOC payment, etc).

Night Deposit Box

Use the night deposit box at your local branch.

Transfer Funds in Online or Mobile Banking

To transfer between your own accounts, you can use the transfer tool which is on the bottom of your screen on the MMFCU Mobile App on your mobile phone (it is under ‘Transfer & Pay’ when logged in to Online Banking). Select the account you want the funds to come from and then select the loan you want to make a payment on. Finally, you will need to select the type of payment you’d like to make.

Make a Loan Payment in Online or Mobile Banking

Make a Loan Payment Tool

To make a payment on a loan with MMFCU using funds from another financial institution, you can utilize our Make a Loan Payment Tool with a debit card or routing and account number from another financial institution.

Direct Pay

To send funds automatically from another financial institution to MMFCU, you can set up a direct pay. This works for loan payments as well. You are also able to set up a direct pay in your local office.

How do I get a cashier’s check from my account?

In Office or Drive-Up

Request a cashier’s check from the teller line.

Over the Phone

Call us at (218) 829-0371 and request a cashier’s check. Please note that not all cashier’s checks can be mailed out, they may request that you come into your local office to pick it up.

How/When are charges processed on my account?

(Overdraft Fees, Direct Deposit and Automatic Payments)

We receive and process automated transactions three times per day: first deposits (like payroll or SSN), then automated payments (like a monthly phone or utility bill paid with your account number). Debit card transactions hit your account any time throughout the day based on the merchant’s processing (store or website), which we do not have control over the timing.

Bill Pay

What is Bill Pay?

Bill Pay is a service that allows you to pay virtually anyone or any company through your online banking account. You determine who you want to pay, when you want to make a payment and which account you want the payment to come from. It’s safe, secure and easy to use.

Who can I pay with Bill Pay?

You can pay virtually any business or individual with a mailing address within the United States and Puerto Rico. Examples: utilities, cable, cell phone, credit cards, or individuals such as a landlord or a babysitter…just to name a few.

How do I enroll in Bill Pay?

It’s easy, just log into Online Banking at the top of this webpage and under the “Transfer & Pay” menu select Bill Pay.

How do I start using Bill Pay?

You start by entering a payee or company’s billing information found on a bill, then enter payment amount and click the date you would like the payment to be made and click SUBMIT.

How are online payments delivered?

Payments are sent one of two ways- electronically or by paper checks. The majority of payments are delivered electronically. Your payment information, such as your account number, is sent via secure transmission. Paper checks are mailed via the Postal Service.

Is Bill Pay secure?

Paying bills online is one of the safest ways to pay bills. It helps guard against identity theft from lost or stolen checkbooks, bills and statements. You maintain tighter control of your accounts with real-time access to your payment activity.

How long does it take for a payment to be received?

When you are scheduling your payment date, you will see the available dates on the calendar that payments can be made. It is typically within 2 to 7 days.

When do funds come out of my account for bills?

Most scheduled payments are sent electronically and funds are withdrawn from your account on the payment date. If your payment is made by paper check, the funds will be withdrawn from your account when the payee deposits the check.

Can I pay bills same day?

Some larger companies accept same day payments. When scheduling your payment date, you will see if there is a same day option for that payee and any cost associated with the same day processing.

Can I pay bills with my phone?

Mid Minnesota’s Bill Pay system allows you more flexibility when and where you want to use it. You can access Bill Pay via a mobile device with the same access and abilities as using Bill Pay on your PC.

Download the MMFCU Mobile App today from iTunes or Google Play.

Do I need to download a new app to use Bill Pay from my phone?

No, you will access Bill Pay from Mid Minnesota’s Online Banking Mobile App.

Download the MMFCU Mobile App today from iTunes or Google Play.

Are there any payment limits when a payment is sent electronically?

Yes, there are limits on the amount you can send for an electronic payment to both a business and an individual.

The following limits apply to payments being sent electronically to a business:

For individuals:

Daily limit – $7,000

Monthly limit – $20,000

For businesses:

Daily limit – $10,000

Monthly limit – $30,000

The following limits apply to payments being sent electronically to an individual:

Maximum limit daily of $1,000 per transaction

Daily limit – $2,000

These are the monthly electronic payment thresholds. Once the sum of payments exceeds the limit, the payment will automatically remit as a check.

Debit/Credit Card

How do I report my debit or credit card as stolen or lost?

To report your card as lost or stolen, please contact our staff during business hours at (218) 829-0371 and use 1-866-820-8776 for your debit card and 1-866-820-3862 for your credit card, after hours and on weekends.

How do I report fraud on my debit or credit card?

To report fraud on your debit or credit card please contact us at (218) 829-0371. We can start the process for you. Or you can call 1-866-820-8776, 24/7 and they will be able to help you.

How do I reset my PIN number on my debit card?

To reset your PIN number on your debit card, please call 1-866-985-2273. You will need to have your debit card handy as well as answer a few security questions.

How do I get a replacement debit card?

To receive a replacement debit card, you can contact us at (218) 829-0371, make an appointment with staff, or go in Online Banking or the Mobile App to get a new card. Staff are able to get you a replacement debit card the same day in an office, or they can order you a new card that you will receive in 7 to 14 business days.

Can I lock or unlock my debit or credit card in case my card is lost, stolen or I suspect fraud?

If your debit or credit card is lost, you can protect yourself by locking and unlocking your card in Online Banking or the Mobile App under “Accounts” and then “Credit and Debit Card.” By doing so you can temporarily block new transactions from going through. You can also order a replacement card, post a travel notice, manage other alerts and controls, and do a balance transfer.

Download MMFCU Mobile App from iTunes or Google Play.

You can also use the MMFCU Cards App to lock and unlock your card. Download the MMFCU Cards App today from iTunes or Google Play.

If I am traveling internationally or nationwide, is there a way to note that so that my debit and/or credit card will work?

If you are planning to travel outside of your normal area of residency, it would be good to note that so that any purchases will not be blocked. You can do so for both an MMFCU debit or credit card in Online Banking or Mobile App.

Download the MMFCU Mobile App today from iTunes or Google Play.

To learn how to set up a travel notification see ‘How do I set up a travel notification for my debit or credit card in Online Banking or Mobile App?’

What if I don’t see my debit or credit card in the card management section of Online Banking or Mobile App?

If you do not see your debit or credit card, please hit refresh. You may need to do this a few times in order to see all of your active debit and credit cards. If your debit card or Health Savings debit card do not have an image showing, but you see other information, you can still manage those cards even if the image isn’t showing.

How do I set up a travel notification for my debit or credit card in Online Banking or Mobile App?

After logging into MMFCU’s Online Banking or Mobile App, go to the “Accounts” menu and select “Credit and Debit Card.” Then move the arrow over the card image to “Manage” each card that you would like to set up travel notifications for. Click on “Travel Notices” and enter in your Start Date and End Date, select whether your travel will be domestic (within the United States) or international and then list the areas you will be traveling to, these can be specific cities (ex: Las Vegas) or states (Michigan, Wisconsin, Iowa). Once finished click ‘Save’. If you will be using multiple cards while on your travels, you have the option in a drop down when setting the travel notice on your first card to add it to other cards.

Please note, if you are going on one trip from say June 19-25 to Michigan and then will be back home for a few days, followed by another trip on June 30-July 5, you will need to do two separate Travel Notices for each trip.

What if there is old information in the travel notification section for my debit or credit card in Online Banking or Mobile App?

If you see an old Travel Notice on your debit or credit card, do not worry. This will not cause any issues at the time. If you need to change or update your Travel Notice, click Edit on the right side and enter in your Start Date and End Date, select whether your travel will be domestic (within the United States) or international and then list the areas you will be traveling to, these can be specific cities (ex: Las Vegas) or states (Michigan, Wisconsin, Iowa). Once finished click Save.

If there are old travel dates on Mobile App, you will need to click on the dates and then you will get the option to ‘Edit’ or ‘Delete’. You can also delete old Travel Notices in Online Banking by selecting ‘Delete’ on the right-hand side.

How do I view my statements for my credit card in Online Banking or Mobile App?

To view your credit card statements in Online Banking or Mobile App, you will need to be subscribed to view them in eDOCS. After logging into MMFCU’s Online Banking or Mobile App, go to the “Accounts” menu and select “eDocs.” This will bring you to the Overview area of “Statements and Notices.” In the “Subscription Settings” find “Credit Card Statements” and go to the right of that row and click on the gear icon. This will pop up a box where you can select to receive your credit card statement by paper (in the mail) or online (in Online Banking or the Mobile App). Once you have chosen which method you would like to receive your statements, click “Continue.” There will be another pop-up making sure that you want to receive your statements by that method. Once you are ready to continue click “Save.” It may take a few moments to process, but you will get a notification on your screen that it was now set up in your eDocuments.

What if I don’t see my credit card statement in Online Banking or Mobile App?

You will need to subscribe to receiving your credit card statement in the eDOCS area of Online Banking and Mobile App. See ‘How do I view my statements for my credit card in Online Banking or Mobile App?’

How do I make my credit card payment from another financial institution in Online Banking or Mobile App?

You have multiple options to pay your Credit Card bill from another financial institution, check with your other financial institution if they have a Bill Pay option that you will be able to use or call MMFCU (218) 829-0371 to set up an automatic payment. There is also an option to make a payment to your MMFCU Credit Card in Online Banking or the Mobile App. Learn more on how to set this up here.

What are fraud alerts?

Fraud alerts are automated phone calls, text messages and emails that are sent when potentially fraudulent purchase activity has been detected on a credit/debit card account. Messages are triggered by the Mid Minnesota Federal Credit Union (MMFCU) fraud detection system.

Text messages will be sent to cardholders in the 50 United States at no charge.

Customers with international telephone numbers will only receive emails. They will not receive text messages or phone calls.

Why am I receiving a fraud alert?

Fraud alerts are sent to cardholders when potentially fraudulent transactions are detected on their accounts. We want to ensure that any questionable transactions were authorized by the cardholder.

Will I get fraud alerts while I am traveling domestically/internationally?

If you are traveling within the US, you will receive phone calls, text messages and emails. You will only receive text messages if your mobile phone plan allows you to receive them while traveling outside of the United States.

How do I update my contact information (phone numbers, email addresses, etc.) for fraud alerts?

You can update your contact information by updating your account profile in MMFCU’s Online Banking or Mobile App, by calling the number on the back of your card, or by visiting a branch.

How do I stop receiving fraud alerts? What should I do if I don’t want to get a fraud alert at a certain phone number?

- You can opt out of text alerts by replying “STOP” to the text message.

- You can opt out of phone calls when the alert system calls you.

- Click on the Unsubscribe link in the email to stop the emails.

- Contact our Call Center to ask to stop receiving fraud alerts.

- Visit a branch to ask to stop receiving fraud alerts.

I accidentally opted out of receiving fraud alerts. How do I opt back in?

If you accidentally opted out of text alerts from a mobile phone, when the digital system calls to verify activity, the system will provide the opportunity to opt back into text alerts for the mobile phone. For all fraud alert types, please call the number on the back of your card to re-enable fraud alerts to an email address, a mobile phone or landline phone number. you can also visit a branch for assistance.

I have a joint account with another cardholder. Why did I not receive a fraud alert?

Fraud alerts are transmitted to the phone number(s) and/or email address associated with the card used at the time of the transaction. If a joint cardholder is receiving alerts it is because that cardholder’s phone number and/or email address is associated with the card transacting. If the fraud alerts should have gone to another cardholder on your account, we ask that you update the contact information for that cardholder.

A legitimate transaction triggered a fraud alert. How long should I wait after responding to an alert to reattempt the transaction?

Upon confirming that a transaction is valid, you may retry the transaction immediately.

I accidentally marked a valid transaction as fraudulent. What do I do now?

When you mark a transaction as fraudulent, the response message you receive will include our fraud detection department’s toll-free number and it asks that you call to review the card activity, or you will receive a call from a fraud detection agent to review. The agent will be able to review the activity with you and clear the card for use.

I accidentally responded to an alert that a fraudulent transaction was valid. What do I do now?

Please report the unauthorized transaction immediately by calling the phone number provided in the alerts or the number on the back of your card. The agent will then take care of marking the transaction as fraud and close the card.

Will I be responsible for paying for the fraudulent charges?

Please monitor your transactions regularly and review your statements very carefully and immediately report any fraudulent activity to us. Responsibility may depend on the type of card you have and should be verified with us immediately.

You may report unauthorized transactions to us in one of two ways:

- Calling us at (218) 829-0371.

- Mailing a written notification to: Mid Minnesota Federal Credit Union, PO Box 746, Brainerd, MN 56401.

What happens if I did not reply to a fraud alert whether via Email, Text or Phone?

Your card may be blocked for use and future transactions would be declined until the fraud alert is cleared.

What phone number should I call if I do not have record of being alerted of suspected fraud and thus do not have the call back phone number?

You may call our Customer Service phone number on the back of the card.

If my card is lost or stolen, will I still receive fraud alerts?

If your card is lost or stolen, when you are issued a new number, your card account is automatically updated, and you automatically retain the ability to continue receiving fraud alerts.

Is the fraud alert service safe and secure?

Yes. Our priority is to protect your personal information. When you return a fraud alert message, we will ask for the unique case # (number) to your specific fraud alert.

Digital Wallets

What is a Digital Wallet?

Digital Wallets securely store your credit and debit cards as digital versions on your mobile device. There are many different apps that you can use to house this information. Each app will help protect your security by not storing your card number or personal information.

Is it safe to use a Digital Wallet?

Digital Wallets often provide enhanced security through information encryption, making them a safer form of payment.

Is there a charge to use a Digital Wallet?

No- it’s FREE. Simply set it up and start using it.

How do I set up my Digital Wallet?

It’s simple. Load your eligible credit or debit card into the digital wallet mobile app of your choosing. Then use your phone to pay on the go, in app or online.

How do I pay with a Digital Wallet?

You can use your digital wallet to pay wherever you see the contactless symbol at a store or merchant. Or use it when you shop online and have the option to select the digital wallet as your payment option when you check out. A digital wallet can also be used for some other services like ride shares, morning coffee or even food delivery services.

Mobile Applications

To find out more about a specific digital wallet application, which devices are supported and what merchants allow the wallet for payment, go to their respective websites:

How do I update a card in my Digital Wallet?

If there are changes to your card such as a different expiration date and/or CVV number, you will want to remove the card in your digital wallet (in the card details section for the card) and add it as a new card with the new information. If your billing address changes, you can update that information for your card in the Card Details Section.

Fraud

How do I report fraud on my debit or credit card?

To report fraud on your debit or credit card please contact us at (218) 829-0371. We can start the process for you. Or you can call 1-866-820-8776, 24/7 and they will be able to help you.

I received a suspicious email from MMFCU, what should I do?

Mid Minnesota will never send you an email asking you to confirm your account number and/or password. If you receive an email asking you to confirm this information, do not reply. If you replied to the email and provided personal information, contact us immediately by calling (218) 829-0371.

I received a suspicious text from MMFCU, what should I do?

MMFCU will never send you a text asking you to confirm your account number and/or password. If you receive a text asking you to confirm this information, do not reply. If you replied and provided personal information, contact us immediately by calling (218) 829-0371.

Mortgage Loans

You just submitted your mortgage application and now you are suddenly receiving unsolicited phone calls, texts and emails from other mortgage lenders. Why is this happening?

You’re not alone.

When you apply for a mortgage through any financial institution or mortgage company, your lender will pull a credit report from the three major credit bureaus: TransUnion, Equifax and Experian. Under the Fair Credit Reporting Act, the credit bureaus can legally sell your contact information within 24 hours of your mortgage application to anyone who wants a list of people currently applying for mortgages. The collective contact information from applicants is often referred to as “trigger leads.” Please note Mid Minnesota Federal Credit Union never sells or shares your contact information.

The good news – you can opt out of being solicited!

The website www.OptOutPrescreen.com is the official Consumer Credit Reporting Industry website for consumers to opt-in or opt-out of offers for credit and insurance products. In addition, you may go to www.donotcall.gov and sign up for the Do Not Call Registry to protect against unwanted phone calls.

If I want to buy a house in a year, what things do you recommend?

Don’t take out new debt for vehicles, credit cards or toys. Pay down any credit card balances to 30% of your limit. Save money so you’ve got funds in your savings in case there is a need for assets or reserves.

Where should I start: look at homes or see what I can afford?

Start with getting pre-approved first. That way you know what price range you should be looking in. Most realtors don’t want to show a property unless you have a pre-approval letter.

Get pre-approved with our expert Home Loan Consultants by filling out an application today.

What kind of credit score do I need to buy a home?

We pull from all three credit bureaus and take the median credit score. Minimum requirements are a 620 for Conventional/Federal Housing Administration (FHA) loans and 600 for Veterans Administration (VA) loans. USDA (United States Department of Agriculture) and Rural Development (RD) loans require a minimum of 640.

What documents do I need to get pre-approved?

You will need the following documents:

- Personal tax returns including all schedules, W2’s and 1099’s (if applicable) for the past 2 years.

- 30 days most recent/consecutive paystubs (3-5 paystubs depending on how often you’re paid).

- If you are self-employed, you’ll need your previous 2 years business returns (all pages)

- You will also need to provide current profit and loss statement, signed and dated, along with 3 months bank statements for business account(s).

- 2 months of bank statements for checking/savings and asset accounts. If you have MMFCU accounts, we are able to pull these for you.

- For all properties owned, a copy of homeowner’s insurance declaration page, property tax statement, and mortgage statement.

- Any retirement/Veterans Administration (VA) income will require an award letter or monthly statement if you receive it.

How does a home buyer decide on a price range? What are the expenses of owning a home (Insurance, Property Taxes, Utilities, Maintenance, Potential Assessments, etc.)?

Determine a monthly payment that is comfortable for your budget. What you can be approved for and what you are comfortable with can be two different numbers. Then from there, determine the estimated purchase price you can afford based on your budget. We’ll discuss an estimated monthly payment in the current market using a rough estimate for property taxes and home insurance. The payment can fluctuate as the home insurance and property taxes can vary depending on home location. Most realtors will help with finding out how much utilities are for a property. Having at least 3 months of savings for “just in case” maintenance (think water heater going out) is a good rule of thumb.

How do I know which type of mortgage loan is best to finance my home?

When you get pre-approved, we will go over the different loans you qualify for and the pros and cons of each so you can make an informed decision.

What are things to consider if I am purchasing a manufactured home compared to a modular home?

There is a list of requirements the manufactured home must meet to be financed. Talk to your lender to make sure it meets the requirements and that there are no concerns. A modular home is considered to be like a traditional home.

Do I need to use a realtor? Is it more helpful to have one or could we go without?

You don’t have to use a realtor. However, they do put together the purchase agreement for you and work on your behalf. If you choose not to use a realtor, you’re responsible for putting together the purchase agreement on your own. If a home is listed by a realtor, you will need to work with a realtor to get you access to view the property.

To qualify for a mortgage, do you need to have money saved?

Not necessarily. But, retirement and asset accounts can be helpful. Reserves (funds in an account) may be needed to show that you have money set aside for a certain time frame. Like 6 months worth of house payments, for example.

Would you recommend purchasing a small piece of property to build equity first, then purchase a home?

Not necessarily, unless you are looking to build on that property in the next few years.

Are there programs to help cover closing cost for first time home buyers, and if so; what are the requirements?

Yes, there are programs and grants that can be applied for. Some are first come first serve once you have signed and accepted the purchase agreement, you can apply. They have income guidelines for approval which can differ based on the program or grant.

Is 20% down payment the standard when looking at buying a home or is that just so you don’t have to have private mortgage insurance (PMI)?

Minimum down payments start as low as 0% to 5% of the purchase price depending on the type of loan you’re doing. 20% isn’t the standard, but it allows you to avoid PMI.

Are down payments on homes required?

Depending on the loan program, your income and in what county you are purchasing in, there may be options for no down payment. Otherwise, we have low down payment options that start as low as 3% of the home’s purchase price.

Are there options for $0 down payment housing loans?

Yes, the United States Department of Agriculture (USDA) /Rural Development (RD) program allows for a $0 down payment if you meet the requirements. You may still need money to cover your closing costs.

Escrowing compared to not escrowing, what is better?

If you escrow your house payment includes property taxes, home insurance and possibly private mortgage insurance (PMI). If you escrow, we pay property taxes and home insurance from your escrow account on your behalf. If you choose not to escrow, you have to pay them on your own. Depending on the type of financing you’re doing, you may have the option to either escrow or pay your own property taxes and home insurance.

What is private mortgage insurance and when is it typically required?

Private mortgage insurance or PMI, is a typed of insurance that most mortgage lenders require when homebuyers put down less than 20% of the home’s purchase price. PMI is designed to protect the lender if the homeowner defaults on the loan. Your mortgage loan servicer must automatically terminate PMI on the date when your principal balance is scheduled to reach 78% of the original value of your home.

What is earnest money?

Earnest money, sometimes called a “good faith deposit,” is a sum of money that is included with your offer to purchase a home. The purpose of earnest money is to tell the seller that you’re serious about purchasing the home.

If I am looking for a home out of town, does my employment need to be in the same town or does that affect where I can purchase a home?

Not necessarily. It depends on the type of job you have and how far your job is from the home. If you’re job allows you to work remotely, there should be no concerns.

If I changed my employment recently, does that affect my income eligibility?

It could. Especially if income goes down from what you were previously making. Generally, we need to show two years of employment history.

Do you need to have the same job for two years to qualify for a mortgage? Can you have any breaks in employment (baby, job change, move, leave of absence from work)?

No, you just need to show a two-year consecutive work history. If there is a gap in employment, an explanation as to why there was a gap is needed.

Need Help

I would like to talk to someone at MMFCU, how do I reach them?

To contact staff during business hours, you can call (218) 829-0371 and have one of our staff transfer you to the employee you are looking to speak with, or you can enter an extension. Some staff have direct lines, which you can call during business hours to speak with them directly.

What if I need help after hours?

When our staff is not available, you can still manage your money through online banking or mobile app services.

To report a debit or credit card lost or stolen, or that there has been fraudulent activity after hours, please call 1-866-820-8776, 24/7 and they will be able to help you.

Online Banking/Mobile App

What are Online Banking and Mobile App system requirements?

In general, Online Banking and Mobile App supports the latest two versions of supported browsers and computing platforms. For more information check below.

| Online Banking | Google Chrome: Latest 2 Versions Firefox: Latest 2 Versions Microsoft Edge: Latest 2 Versions Safari: Last 2 Major Versions, or 1 Major Version if over 1 year old |

| iOS | Current and prior two major versions (iOS 17, 16, and 15) |

| Android | v9.0 and above |

| Mac Operating System | macOS 14 (Sonoma), 13 (Ventura), or 12 (Monterey) |

| Windows Operating System | Windows 11 or 10 |

If you do not know the version you are using and you get an alert, check to make sure you do not have a version listed below. If you do, you will want to update that browser.

Chrome: version 66 and older

Firefox: version 59 and older

Internet Explorer: any version (no longer supported)

Safari: 11 and older

Android Chrome: 66 and older

IOS Safari: 11 and older

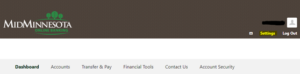

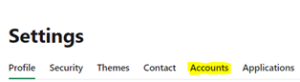

How do I hide accounts in Online Banking?

Once you are logged into your Online Banking, click on Settings in the banner at the top right of the screen.

Once you are on the Settings screen, click Accounts.

On the Accounts screen locate the account that you would like to hide. Once you have found the account, click on the pencil icon to open the details for the account. Check the box for Hide This Account and choose Save.

If you decide in the future that you would like to see the account again, navigate back to the Account details for that account and uncheck the box for Hide This Account.

How do I hide accounts in the Mobile App?

Once you have logged into the Mobil App, click on More from the menu at the bottom of the screen.

On the next screen under Utilities, select Settings.

On the Accounts screen, locate the account that you would like to hide. Click on the arrow on the right-hand side to open the details for the account. Slide the radial button to ‘On’ for Hide This Account and choose Save at the top of the screen.

In the future, if you decide that you would like to see the account again, navigate back to the Account details for that account and slide the radial button to ‘Off’ for Hide This Account.

How do I access my account online?

To access your account online, you must register for online banking or the mobile app.

How do I transfer funds in the mobile app?

To transfer between your own accounts, you can use the transfer tool which is on the bottom of your screen on your mobile phone or android.

You can also use this tool to transfer funds from your account to another MMFCU member, you will need to know the business name or first and last name of who you would like to transfer funds to, as well as the account number that the funds need to go into. To transfer to another member, you would need to click the add account button when you get the deposit account (or the account you want the funds to go to).

How do I sign up for electronic statements?

To sign up to receive your statements electronically every month, you will need to be registered and use Online Banking to view your statements. Then, sign up for E-DOCS. Once you sign up for E-DOCS, you will receive all notices electronically for statements, tax forms, late notices, etc.

How do I stop a payment using Online Banking?

- Over the phone at (218) 829-0371

- In-person at your local office

- In Online Banking

Log into online banking. In the navigation bar at the top hover over Transfer & Pay and select Draft Services. There will be two tabs in the top center of the page, make sure the Stop Payment tab is clicked. Then click the green New Stop Pay Request button to the right.

In the top drop down, select the account that the check was written off of. In the second box, put your full check number, this is located in the upper right corner of your checks and should be located on the carbon copy (if you don’t have a carbon copy, please look at your check register for the check number). If you have one check, you will just enter your number in the box. Enter the exact amount of the check.

If you have a range of checks that need to be stopped, you will put the 1st check you would like to stop (lowest number), then click the range box and enter the last check you would like to stop (largest number). In the Amount field, enter the exact amount (total) of the range of checks.

You are also able to search to see if the check you want to stop has cleared by searching matching transactions. In the Payee Name enter the name on the first check that you paid. Read the Stop Payment Policy, before clicking the “I agree” check box and submitting the request.

**You will be charged $25 service fee per each stop payment.

How long is my transaction history available to me in Online Banking?

To limit the storage of personal data, transactions for both member and business accounts will be available going back 24 months for all members.

You may retain transaction history on your accounts by downloading from online banking or a history of all account statements is available in E-DOCS in Online Banking or the Mobile App.

For Example:

As of April 1, 2022 I will see transactions dating back to: April 1, 2020

As of March 1, 2022 I will see transactions dating back to: March 1, 2020

As of February 15, 2022 I will see transactions dating back to: February 15, 2020

What if I don’t see my debit or credit card in the card management section of Online Banking or Mobile App?

If you do not see your debit or credit card, please hit refresh. You may need to do this a few times in order to see all of your active debit and credit cards. If your debit card or Health Savings debit card do not have an image showing, but you see other information, you can still manage those cards even if the image isn’t showing.

How do I set up a travel notification for my debit or credit card in Online Banking or Mobile App?

After logging into MMFCU’s Online Banking or Mobile App, go to the “Accounts” menu and select “Credit and Debit Card.” Then move the arrow over the card image to “Manage” each card that you would like to set up travel notifications for. Click on “Travel Notices” and enter in your Start Date and End Date, select whether your travel will be domestic (within the United States) or international and then list the areas you will be traveling to, these can be specific cities (ex: Las Vegas) or states (Michigan, Wisconsin, Iowa). Once finished click ‘Save’. If you will be using multiple cards while on your travels, you have the option in a drop down when setting the travel notice on your first card to add it to other cards.

Please note, if you are going on one trip from say June 19-25 to Michigan and then will be back home for a few days, followed by another trip on June 30-July 5, you will need to do two separate Travel Notices for each trip.

What if there is old information in the travel notification section for my debit or credit card in Online Banking or Mobile App?

If you see an old Travel Notice on your debit or credit card, do not worry. This will not cause any issues at the time. If you need to change or update your Travel Notice, click Edit on the right side and enter in your Start Date and End Date, select whether your travel will be domestic (within the United States) or international and then list the areas you will be traveling to, these can be specific cities (ex: Las Vegas) or states (Michigan, Wisconsin, Iowa). Once finished click Save.

If there are old travel dates on Mobile App, you will need to click on the dates and then you will get the option to ‘Edit’ or ‘Delete’. You can also delete old Travel Notices in Online Banking by selecting ‘Delete’ on the right-hand side.

How do I view my statements for my credit card in Online Banking or Mobile App?

To view your credit card statements in Online Banking or Mobile App, you will need to be subscribed to view them in eDOCS. After logging into MMFCU’s Online Banking or Mobile App, go to the “Accounts” menu and select “eDocs.” This will bring you to the Overview area of “Statements and Notices.” In the “Subscription Settings” find “Credit Card Statements” and go to the right of that row and click on the gear icon. This will pop up a box where you can select to receive your credit card statement by paper (in the mail) or online (in Online Banking or the Mobile App). Once you have chosen which method you would like to receive your statements, click “Continue.” There will be another pop-up making sure that you want to receive your statements by that method. Once you are ready to continue click “Save.” It may take a few moments to process, but you will get a notification on your screen that it was now set up in your eDocuments.

What if I don’t see my credit card statement in Online Banking or Mobile App?

You will need to subscribe to receiving your credit card statement in the eDOCS area of Online Banking and Mobile App. See ‘How do I view my statements for my credit card in Online Banking or Mobile App?’

How do I make my credit card payment from another financial institution in Online Banking or Mobile App?

You have multiple options to pay your Credit Card bill from another financial institution, check with your other financial institution if they have a Bill Pay option that you will be able to use or call MMFCU (218) 829-0371 to set up an automatic payment. There is also an option to make a payment to your MMFCU Credit Card in Online Banking or the Mobile App. Learn more on how to set this up here.

Remote Deposit

How do I endorse the back of a check for Remote Deposit?

You’ll need to endorse the back of your check before you deposit it through Remote Deposit in the Mobile App. You’ll need to do the following:

- Write ‘For Mobile Deposit’ or check the “For Mobile Deposit Only” box on the back of the check.

- Write your MMFCU Account Number, Member Number or ‘For MMFCU’

What are some reasons my check may not get accepted?

Some of the typical reasons checks are not accepted with Remote Deposit are:

- Missing one of the endorsements noted above.

- Depositing a check made payable to two people, but the account is only for one of those individuals.

- Check is made out to someone other than who is on the account.

- The check is made payable to a business, yet the account selected for deposit is a personal account.

- The check amount entered in the Remote Deposit form is a different amount than on the check.

- The check needs to have a darker background for the image to work.

Will I be notified if my Remote Deposit is not accepted?

Yes. You will receive a message in Online Banking notifying you that your check was not accepted and the reason.

What is the daily cutoff for Remote Deposits?

Daily cutoff for same day processing is 4:30pm. Funds deposited after 4:30pm (or a on a non-business day) will be available the following business day by 11am.

SavvyMoney®

How does SavvyMoney® Credit Score differ from other credit scoring offerings?

SavvyMoney® pulls your credit profile from TransUnion, one of the three major credit reporting bureaus, and uses VantageScore 3.0, a credit scoring model developed collaboratively by the three major credit bureaus: Equifax, Experian, and TransUnion. This model seeks to make score information more uniform between the three bureaus to provide consumers a better picture of their credit health.

Why do credit scores differ?

There are three major credit-reporting bureaus—Equifax, Experian and Transunion—and two scoring models—FICO or VantageScore—that determine credit scores. Financial institutions use different bureaus, as well as their own scoring models. Over 200 factors of a credit report may be taken into account when calculating a score and each model may weigh credit factors differently, so no scoring model is completely identical. No matter what credit bureau or credit scoring model is used, consumers do fall into specific credit ranges: Excellent 781–850, Good 661-780, Fair 601-660, Unfavorable 501-600, Bad Below 500.

Will MMFCU use SavvyMoney® Credit Score to make loan decisions?

No, MMFCU uses its own lending criteria for making loans.

Will SavvyMoney® share my credit score with MMFCU?

No, your SavvyMoney® Credit Score is a free service to help you understand your credit health, how you make improvements in your score and ways you can save money on your loans with MMFCU.

If the financial institution doesn’t use SavvyMoney® Credit Score to make loan decisions, why do we offer it?

SavvyMoney® Credit Score can help you manage your credit so when it comes time to borrow for a big-ticket purchase—like buying a home, car or paying for college—you have a clear picture of your credit health and can qualify for the lowest possible interest rate. You’ll also see offers on how you can save money on your new and existing loans with MMFCU.

Text

Why am I receiving text messages from Mid Minnesota Federal Credit Union?

Mid Minnesota uses text as a way to keep you informed of your account(s) and services. You can set-up text message alerts on your accounts within Online Banking and the Mobile App in the “Alerts” widget. This tool allows you to be notified for a variety of reasons including when a deposit or withdrawal occurs, if your account reaches a specific balance, as well as indicate if you want the alerts sent to you via text or email. Mid Minnesota will also text you if there is a service disruption, like an office closed for an extended period of time, or if you need to contact us for a specific question or concern about your account. Text messages from Mid Minnesota Federal Credit Union could come from the three following 5-digit numbers: 43783, 49447, 66368, or 67669 or the following 10-digit number: (866) 597-2025.

Wires

What instructions do I need to receive a wire into my account at MMFCU?

To receive a wire into your account at MMFCU, please give the financial institution sending the wire the following information:

- Mid Minnesota Federal Credit Union’s Routing Number: 291973360

- The account number that you would like the funds deposited into when received.

All incoming wires must match the account holders name and account number. Any incoming wires with account name or number not matching MMFCU account holders will be returned to the sender.

The wiring instructions are the same for International Wires. MMFCU does not have a swift code, so if that is being requested, the wire may need to be routed through a larger financial institution such as US Bank, Wells Fargo, etc. and then onto MMFCU.

Are there any special wiring instructions needed to receive a wire internationally?

The wiring instructions are the same for an international wire as they are for a domestic wire. Please see the above instructions or print the instructions here.