Online Banking Services

Take MMFCU with you, wherever you go. Manage your money easily whether you are across town or across the country.

Easy and Convenient

Looking for a way to manage your accounts 24/7 from the comfort of your home, at the kids’ soccer game or from the white sands of the beach you’re vacationing at? With Mid Minnesota Online Banking services we have ways for you to stay up to date on all things happening with your accounts. From depositing a check in our Mobile App to transferring funds in Online Banking, and even setting up alerts and controls on your MMFCU Debit or Credit Card, rest assured you have access to managing your accounts as if you were in one of our offices.

Credit Union Banking at Your Fingertips

Online Banking

Discover more ways to monitor your accounts in Online Banking. Make transfers from one account to another, or even from you to another member! Make payments to your loans at MMFCU with a click of a button, print statements or other important documents, or even set up a savings budget.

Mobile App

Banking anywhere you are is easy with MMFCU’s Mobile App. Similar to Online Banking, you can manage your accounts 24/7 with just your mobile phone! With additional online services that allow you to deposit a check into your account from anywhere, transfer funds and even monitor your credit score!

Bill Pay

Pay your bills anytime, anywhere. Set up automatic payments or monitor your payments in our free online bill pay in both Online Banking and Mobile App. Business members also have access that is geared towards their business’ needs.

Remote Deposit

Make your check deposits from the comfort of your home or out running errands with Remote Deposit in the Mobile App. Don’t worry about finding time to go to an MMFCU office to deposit your checks when you have access 24/7.

Digital Wallets

The way we pay for our purchases in-store and online is always changing. Stay up-to-date by adding your Mid Minnesota debit or credit card to the digital wallet of your choice.

Paperless Banking

Receive important account information and notifications quickly and securely with Paperless Banking using E-DOCS. You can receive statements, tax documents and notices in Online Banking or the Mobile App. Don’t miss out on those important pieces of monitoring your accounts.

Alerts and Controls

Alerts & Controls for MMFCU Credit and Debit Cards are available in Online Banking and Mobile App. Using these tools help you stay informed of your card activity and protect against fraud, so please take a few minutes to set-up your preferred Alerts & Controls for each Debit and Credit Card.

After logging into MMFCU’s Online Banking or Mobile App, go to the “Accounts” menu and select “Credit and Debit Card.” Then move the arrow over the card image to “Manage” each card determining the notifications you want to receive and/or limitations you want to set, options include:

- International Transactions

- Transaction Limits

- Transaction Types

- Merchant Types

When needed, you also have the ability to:

- Set Travel Notices,

- Lock and Unlock your card if you temporarily misplace it or are concerned about charges, and

- Make Balance Transfers.

You can find additional details on our Frequently Asked Question page.

Make a Loan Payment

Payments are made easy at MMFCU.

Write a check, have us deduct them from your paycheck, make payments at an office or in online banking, or even set up automatic withdrawals. Choose whatever works best for you!

Monitor Your Credit Score In Online Banking or the Mobile App

Mid Minnesota Federal Credit Union has your financial well-being as our number one priority, so we are making it easy for you as we partner with Savvy Money® so that you can monitor your credit score while using online and mobile banking.

- Start by logging into online or mobile banking.

- Then click “Check Your Score” where you see an image similar to the one shown here.

- Annually, download your full credit report from annualcreditreport.com and read through them carefully using the Credit Report Checklist as a guide of what errors to look for. Make three copies of the checklist, one for each of the three nationwide credit reporting companies: Equifax, Experian and TransUnion.

- If you find any mistakes on your credit reports, you should dispute them and we can help. Mid Minnesota has a Disputing errors on your credit reports resource that walks you through how to do this.

- Continue to monitor your score to ensure you have not been a victim of identity theft.

Frequently Asked Questions

How do I hide accounts in Online Banking?

Once you are logged into your Online Banking, click on Settings in the banner at the top right of the screen.

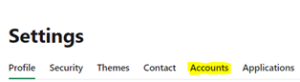

Once you are on the Settings screen, click Accounts.

On the Accounts screen locate the account that you would like to hide. Once you have found the account, click on the pencil icon to open the details for the account. Check the box for Hide This Account and choose Save.

If you decide in the future that you would like to see the account again, navigate back to the Account details for that account and uncheck the box for Hide This Account.

How do I hide accounts in the Mobile App?

Once you have logged into the Mobil App, click on More from the menu at the bottom of the screen.

On the next screen under Utilities, select Settings.

On the Accounts screen, locate the account that you would like to hide. Click on the arrow on the right-hand side to open the details for the account. Slide the radial button to ‘On’ for Hide This Account and choose Save at the top of the screen.

In the future, if you decide that you would like to see the account again, navigate back to the Account details for that account and slide the radial button to ‘Off’ for Hide This Account.

How do I access my account online?

To access your account online, you must register for online banking or the mobile app.

How do I know what is pending on my account?

To know what is pending on your account you can either call us at (218) 829-0371 or log into online or mobile banking. To see pending purchases or debits on your account, click on one of your accounts in online or mobile banking. Pending transactions will be listed at the top and marked as pending.

For pending deposits, you can contact us and our staff will be glad to help you.

Why do credit scores differ?

There are three major credit-reporting bureaus—Equifax, Experian and Transunion—and two scoring models—FICO or VantageScore—that determine credit scores. Financial institutions use different bureaus, as well as their own scoring models. Over 200 factors of a credit report may be taken into account when calculating a score and each model may weigh credit factors differently, so no scoring model is completely identical. No matter what credit bureau or credit scoring model is used, consumers do fall into specific credit ranges: Excellent 781–850, Good 661-780, Fair 601-660, Unfavorable 501-600, Bad Below 500.

How do I sign up for electronic statements?

To sign up to receive your statements electronically every month, you will need to be registered and use Online Banking to view your statements. Then, sign up for E-DOCS. Once you sign up for E-DOCS, you will receive all notices electronically for statements, tax forms, late notices, etc.