Side Hustle or New Career?

Whether your business is a side hustle or something you are looking to build into a career, Mid Minnesota Federal Credit Union has experts, experience, and services to help you grow.

Let us know who you are and little about your business through this secure form and file upload.

We’ll reach out to learn more and work together to make running your business and money management easier.

Here are a few things we will need to get you started…

If you are just starting out and need a business checking or savings account we will ask for these items, depending on what type of business you are we may need a few other documents:

- State of Minnesota Registration Documents (Don’t have this yet? See the Business Registration link below)

- Driver’s License

- If you need an Employer ID Number (EIN) see Internal Revenue Service (IRS) link below.

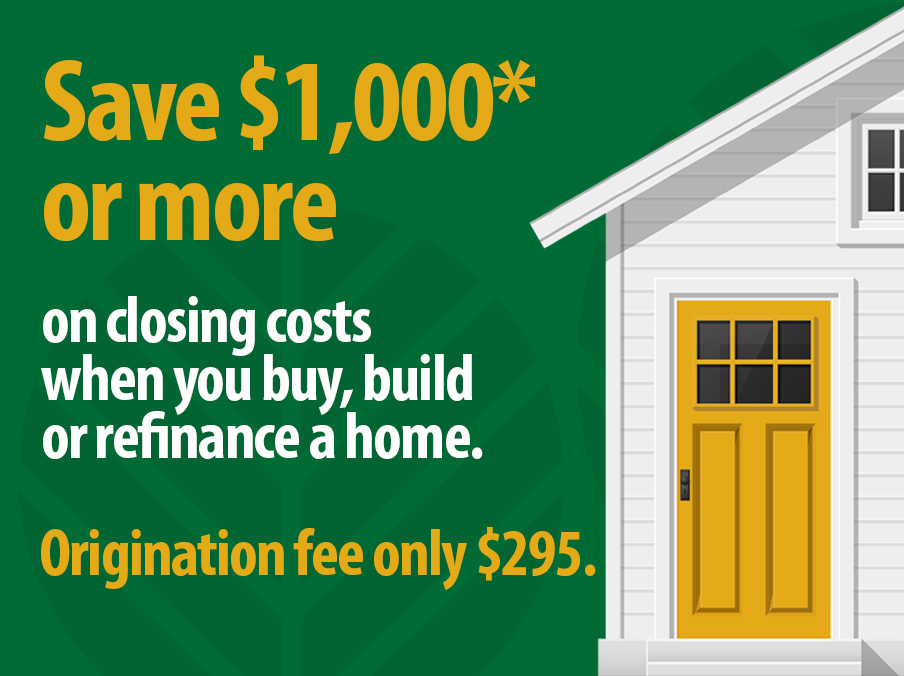

If you are seeking a loan, we will typically need:

- Most current two year’s taxes business and/or personal.

- Current year profit and loss statement & balance sheet (if available).

- Personal financial statement.

- Business debt schedule.

Additional Online Resources to Support Your Business

Local Small Business & Economic Development Organizations

Small Business Development Centers

Economic Development Organizations

Aitkin County Economic Development

Alexandria Area Economic Development

Becker County Economic Development

Cass County Economic Development

Crow Wing County Economic Development

Fergus Falls Regional Development

Morrison County Economic Development

Norman County Economic Development

Otter Tail County Economic Development

Staples Economic Development

Todd County Economic Development

Wadena County Economic Development

Your Local Business Lenders

Scott Antolak

A decade of commercial and business lending knowledge to help your business. He received a Political Science degree from Saint John’s University and a Masters in International Business from Saint Mary’s University. Contact Scott by email: santolak@mmfcu.org or by phone: (218) 822-5110.

Cody Einerson

The credit union difference of “people helping people” is lived out by both supporting local business owners in achieving their dreams, by serving on the Becker County United Way Board, and on the ice as an assistant coach for the Detroit Lakes High School Boys Hockey team. Contact Cody by email: ceinerson@mmfcu.org or by phone: (218) 325-6536.

Why MMFCU?

It’s time to do banking differently. At MMFCU, we believe that true financial growth can only happen when we all grow together.

Credit union business banking is rooted in locals serving locals, for the good of our community. We care about this community because it’s our home too. When you progress, so do we and in turn, we help others do the same. Owned by members (that’s you!) and led by members–that’s the credit union difference.

Discover MMFCU 2023 Annual Report